2025 Insights from the Practice Management Index

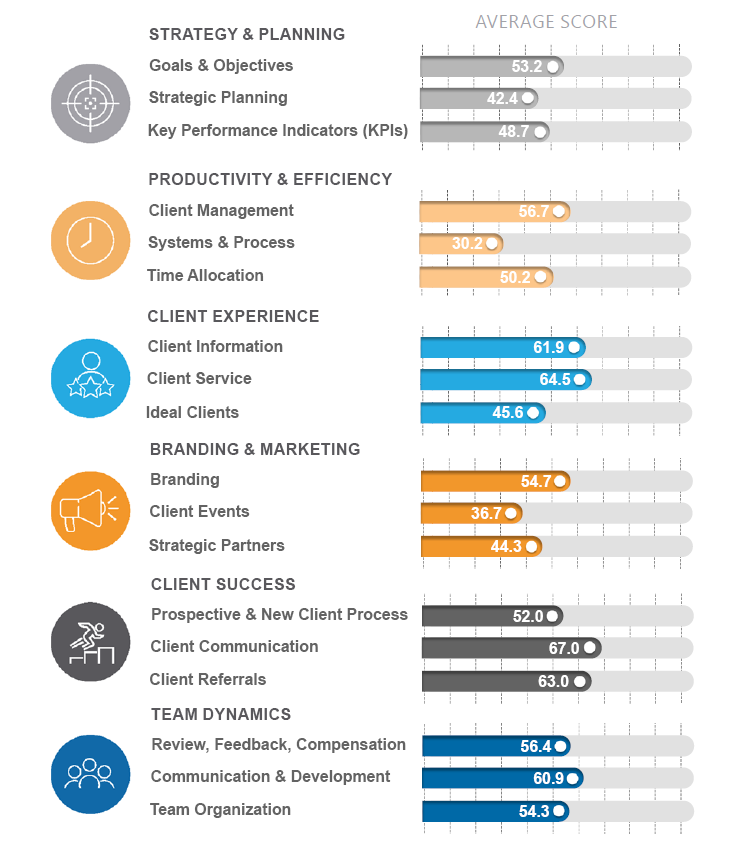

In this year's 2025 Practice Management Trends Report, our goal is to uncover the drivers of success by analyzing the activities and strategies that financial advisors focused on throughout 2024. We seek to identify the "opportunity gaps" between a business' current state and its full potential. Understanding these gaps is crucial for financial advisors looking to refine their operations, enhance client engagement, and drive enterprise value in their business.

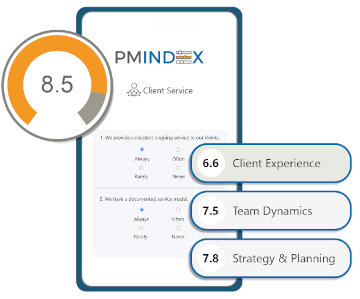

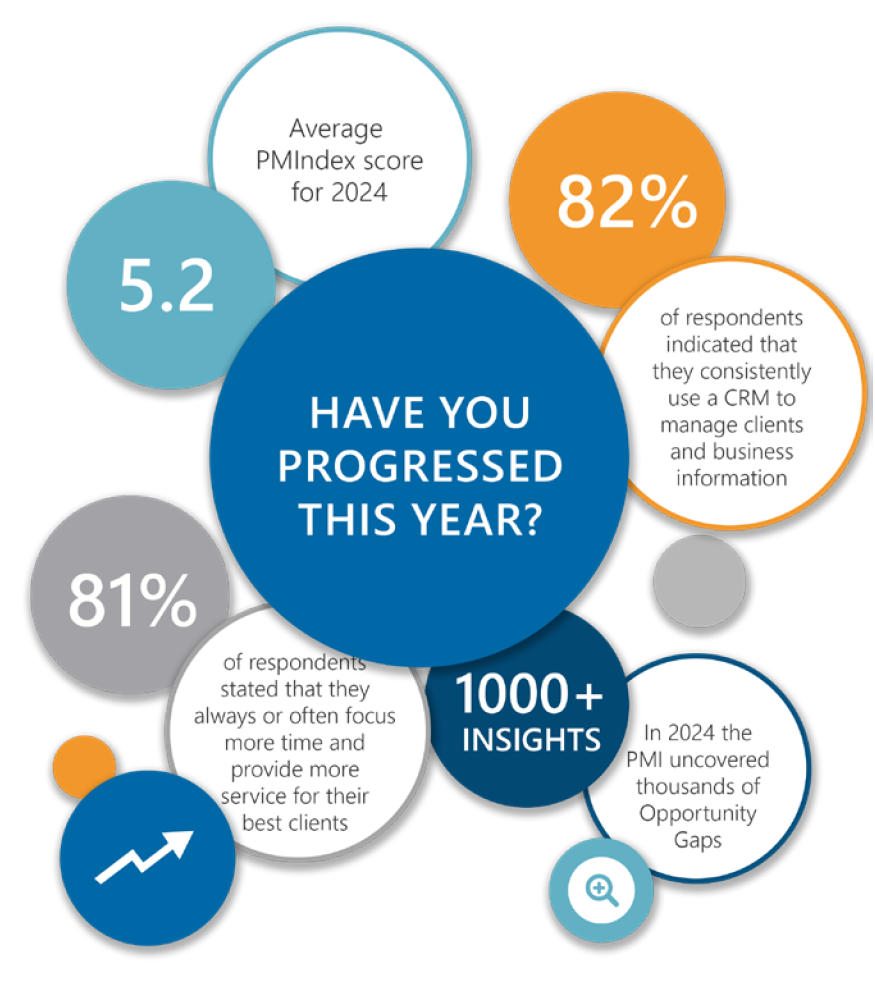

Since the launch of the Practice Management Index in 2022, thousands of financial advisors have used this tool to pinpoint areas for meaningful improvements in their practices. The data collected in 2024 reveals an industry at a crossroads; traditional practice management approaches are being reimagined with the integration of AI, streamlined processes, and a client-first mindset.

This report examines these evolving dynamics, offering insights into what the most successful financial advisors did differently in 2024. Are you operating your business at its full potential? What opportunity gaps exist that, if addressed, could propel your practice to new levels of growth in 2025?

Join us as we examine these questions and more, providing you with actionable insights to transform your approach to practice management and drive success in the year ahead. Download the full 2025 Practice Management Trends Report

Contents

- The Practice Management Index

- Respondents Profile

- Have You Progressed This Year?

- Financial Industry 2024 PMI Scores

- Where Do Financial Professionals Stand?

- Where Respondents Excelled and Fell Short

- Pillar 1: Strategy and Planning

- Pillar 2: Productivity and Efficiency

- Pillar 3: Branding & Marketing

- Branding & Marketing: Client Events

- Pillar 4: Client Experience

- Pillar 5: Client Success

- Pillar 6: Team Dynamics

- Average Overall Scores of the Six Pillars

- How Will You Progress This Year?

The information, evaluation and insights in this report are derived from the Practice Management Index (PMI), which is a detailed assessment of a financial team's practice

management capabilities.

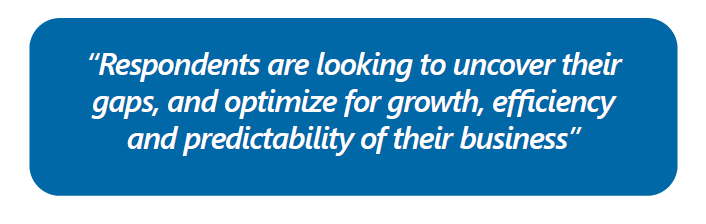

The PMI provides a quantitative measure for financial teams to know "where they rank" compared to their peers, with an overall PMI score on six integral pillars of their business and 18 focus areas in practice management. The data is aggregated and derived from the 174+ point PMI assessment, and the intake form comprising demographic and socioeconomic information - including the number of financial professionals on a team, staff, clients, Assets Under Management, annual revenue, and percentage of recurring revenue. This data is used to uncover hidden patterns, unknown correlations and trends that provide useful business insights across the industry. You will find such insights in this report. In addition, this report will provide a meaningful comparison for the Financial Professionals that have completed the PMI, so that they can compare themselves to their peers within the industry. Our intent is to provide Financial Professionals with a benchmark of success, so that each year they can measurably and progressively run a more productive and predictable business, become a better team, and a better version of their former selves.

You can take your PMI for 2025 at this link: practicemanagementindex.com

The Practice Management Index (PMIndex)

This report uses data gathered from respondents who are financial professionals within North

America. Commonalities shared by respondents are that they:

- Dedicate time to improving their business through practice management, relationship management, marketing and business development.

- Often are teams that may be stuck in the status quo, and want to gain clarity on the gaps that exist within their business.

- Are individuals and businesses motivated to see new levels of growth, efficiencies, productivity and predictability in their business.

No personally identifiable information is used in this report.

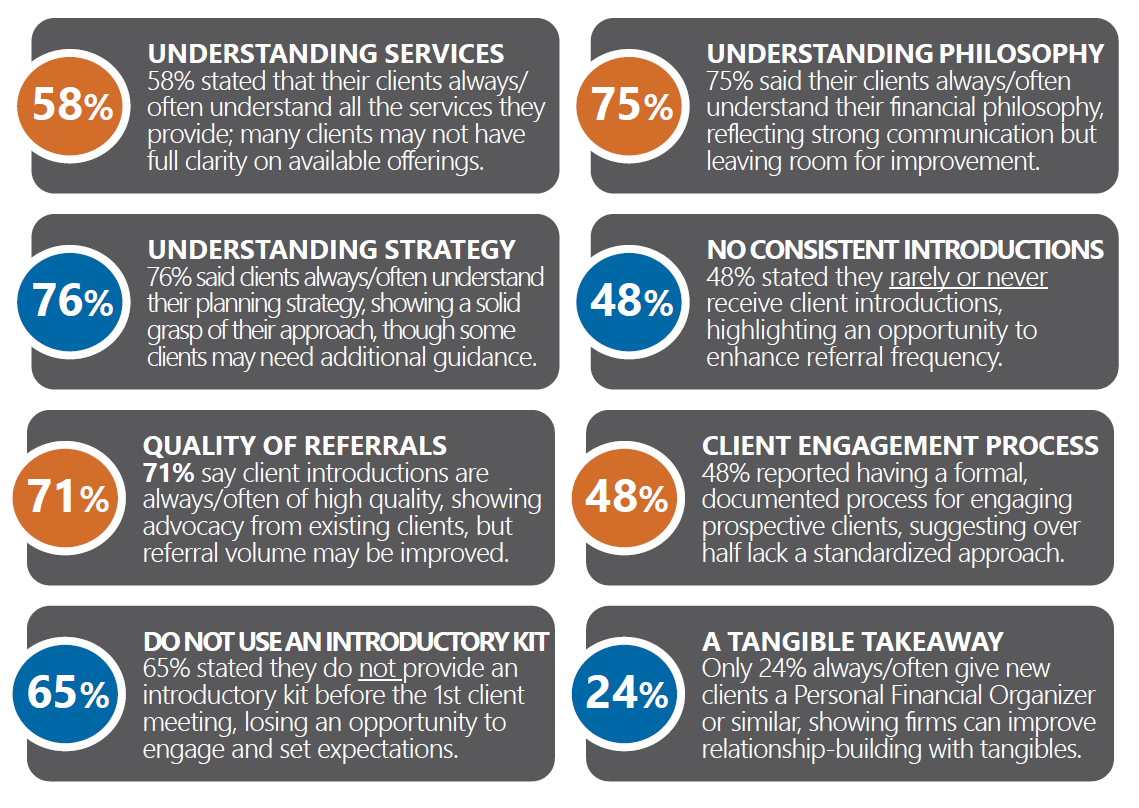

Where Respondents Excelled and Fell Short

The following pages provide a snapshot of the most significant trends and opportunity gaps for financial professionals and teams identified through the PMIndex in 2024

Pillar 1: Strategy & Planning

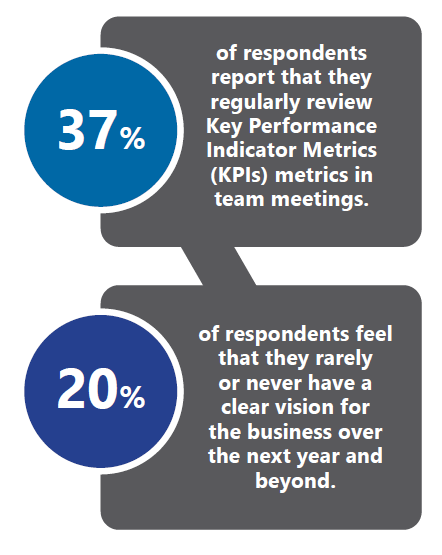

Strategic planning is much more than just making a one-time plan; it's a continuous, flexible process that shifts and grows with your business and the team you work with.

It's about diving deep to find both opportunities for growth and potential risks, really understanding what the practice does well and where it can improve. You need to bridge the gap between what you plan to do and what actually gets done by setting clear, achievable goals, keeping an eye on key performance metrics, and planning for what's coming next.

Essentially, strategic planning is all about being proactive, well-informed, and quick to adapt, and ready to pivot on a dime, ensuring your practice isn't just making it through but thriving.

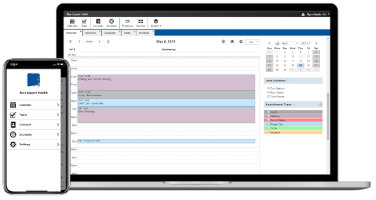

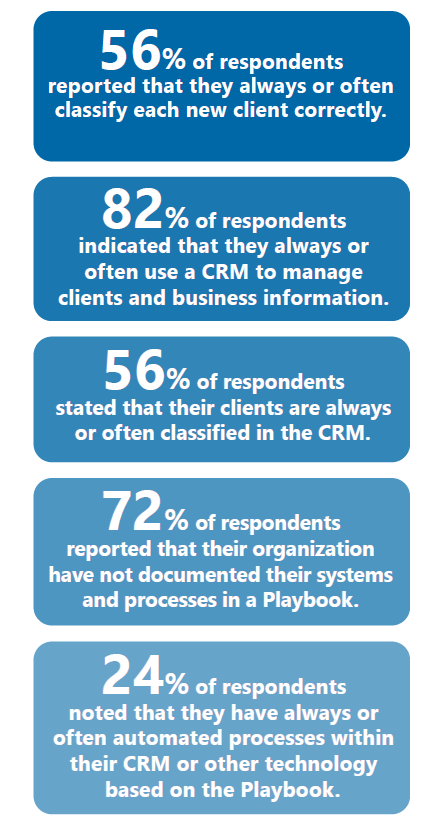

Pillar 2: Productivity & Efficiency

What is the secret to skyrocketing productivity? It lies not in working more hours, but in working smarter. Those that clearly assign roles & responsibilities and cleverly handed off routine tasks to others in and outside the financial advisor's team, end up freeing more time to higher priority activities and client interactions. Now, advisors have the time to really focus on what they do best; connecting with clients and strategic partners who are the real MVPs in the growth and happiness of the practice.

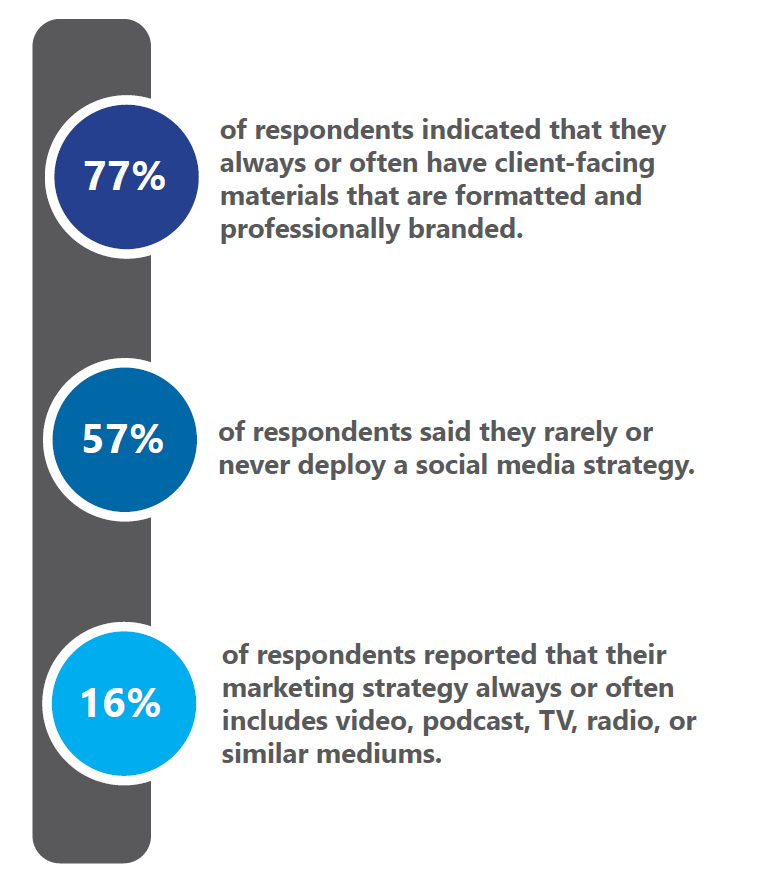

Pillar 3: Branding & Marketing

Create a brand identity that resonates with clients and sets expectations they can get excited about. Your, personal and business, branding & marketing strategy needs to ensure prospective and existing clients understand and appreciate everything can do for them for the lifetime of your relationship. It's not just about communicating your

value in various mediums like your website or on social media, it's also about demonstrating your value with every interaction with clients, through the people on your team, your practice and your process.

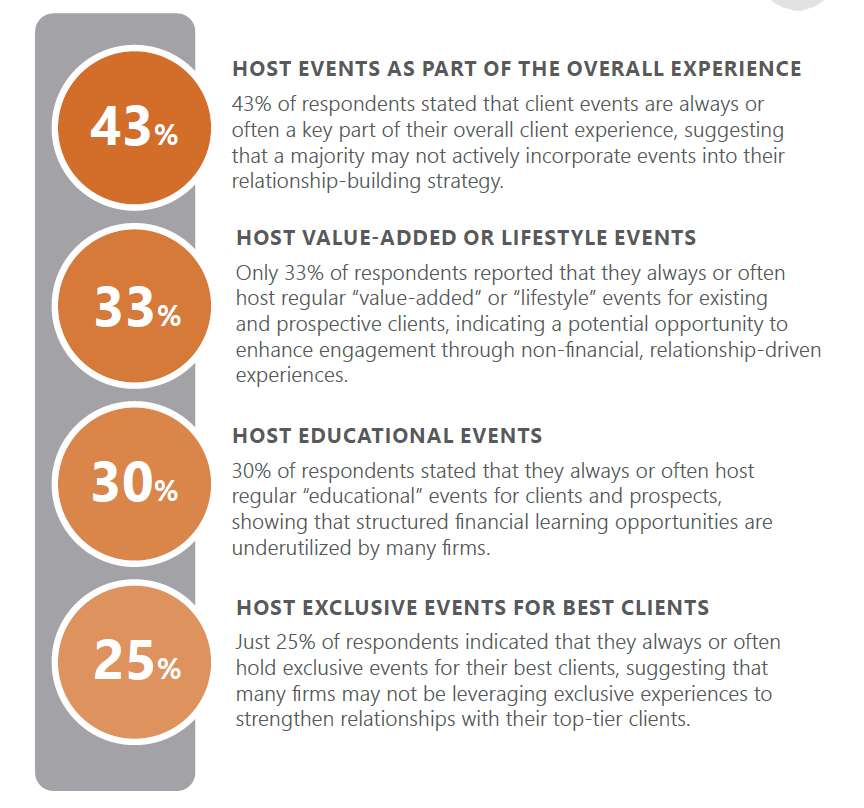

Branding & Marketing: Client Events

Pillar 4: Client Experience

Don't just service your clients; aim to give them an experience they'll want to rave about. Switch from being reactive to anything that comes up, to actually planning it out, providing proactive service that makes every interaction, meeting, or call really count. This is about making your interactions so valuable that your clients feel more connected to you than ever. Develop your service model to be elevated for your best clients, distinct from the competition, and a magnet for new clients.

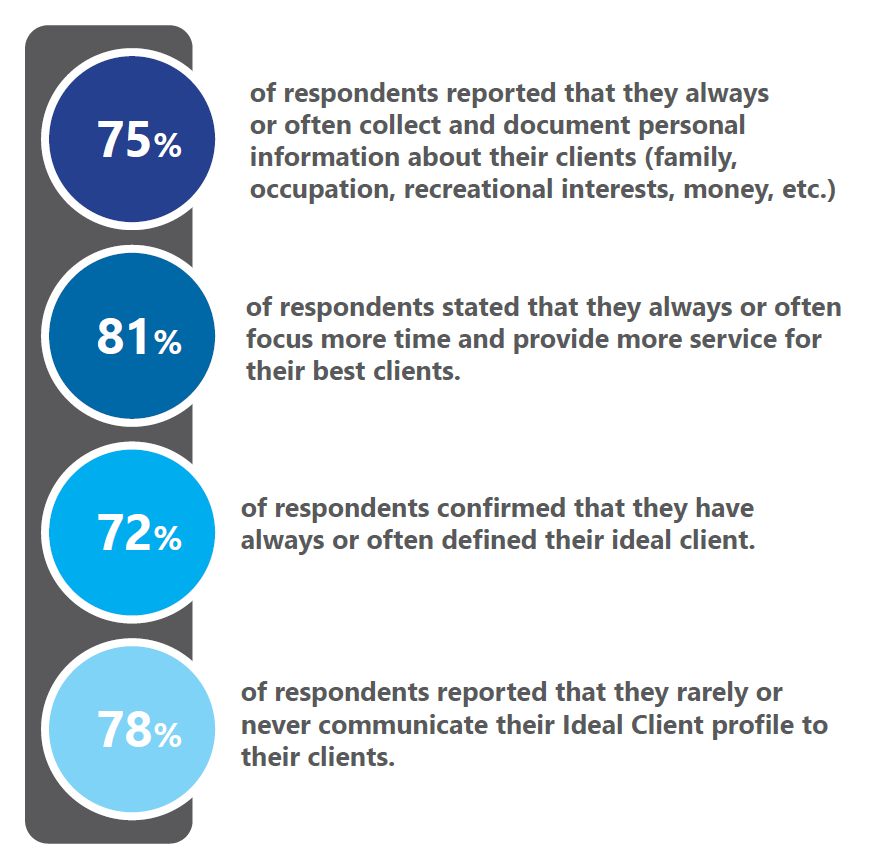

Pillar 5: Client Success

What can be simpler? Focus on the success of the client, rather than your success. Focus on developing a culture that is client centered, so that every thought, process, and interaction is about your clients and the experience you provide. Everything from your new client fit process, to implementing a consistent onboarding strategy to welcome clients into the practice. Central to this approach is identifying and working closely with ideal clients whose needs and expectations align perfectly with your expertise. Your business will be a reflection of what you put into it; your success will be a byproduct of your client's success.

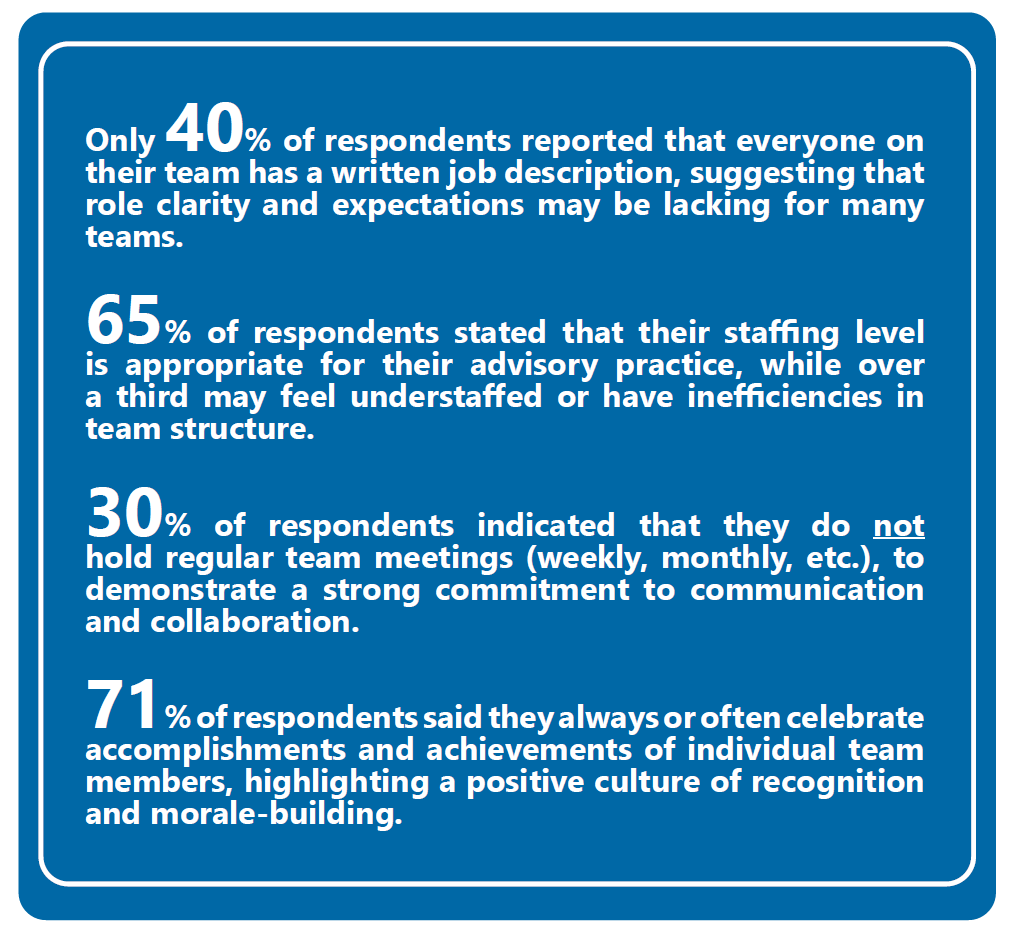

Pillar 6: Team Dynamics

Team dynamics are the heartbeat of a financial practice, with the environment and culture taking their cues from the top. Your team isn't just part of the machinery; they're the driving force. Where every team member feels charged up and in sync with the practice's objectives, where everyone belongs, where growth is on the daily agenda, where consistent communication actually happens, and innovative ideas are freely discussed. Does this sound like a team that you would like to be a part of?

How Will You Progress This Year?

The insights of 2024 underscore why Financial Advisors need to continuously refine their practices. Excellence in the years ahead will be defined by a commitment to self-improvement and the effective use of technology to enhance both productivity and the client experience.

The cornerstone of this adaptation is the development of a comprehensive playbook; a strategic framework for delivering a consistent client service, increasing organic growth, and driving enterprise value. This year presents a choice: innovate or stagnate. Your playbook is not merely a plan; it's your roadmap to leading the future. Success will be determined by your capacity to evolve and meet the changing needs of your clients.

What can you do now, to begin your journey of optimization? It starts here:

- Uncover Your Gaps - Determine specific action items that you can take to begin to reach the full potential of your business. You can take your PMIndex for 2025 at this link (45minutes): practicemanagementindex.com

- Hire a Coach or a Mentor - Find a financial advisor coach that can provide an outside view on your business, but also provide accountability and implementation support.

- Build your Plan - Outline what steps and action items you will implement. Financial advisors can utilize the PMI reporting as the foundation for this plan.

- Take Action - Don't just put a plan together, be accountable to it. Using coaching programs with resources, templates, worksheets, scripting, agendas and tutorials can provide the foundation for implementation.

- Annual assessment - Monitor your progress by completing the Practice Management Index annually. This will provide you with a framework for meaningful and measurable progress over time.

Download the detailed 2025 Practice Management Trends Report