Integrating FORM into Your Client Goal Setting Process

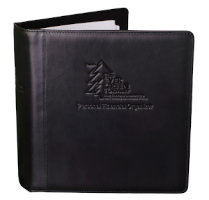

Of the many steps of the personal branding process that can fast-track clients to advocacy, integrating FORM has to be among the easiest. When you on-board a new client or have a review meeting with an existing client, ensure that there is a tab in their Personal Financial Organizer (The PFO Binder that is the central hub of your relationship) that outlines the importance of FORM. Simply explain that you take a holistic and panoramic approach to client relationships and that part of your process is to know as much about your clients' Family dynamics, Occupational issues and Recreational interests as you do about their Money.

Many clients will be amazed that you are so thorough and comprehensive. A few will wonder what the real benefits are. Either way, to drive the point home further, integrate FORM with your client goal setting process. But again, be panoramic and all encompassing. Sure you want to understand their financial goals, but you really want to understand what money means to them holistically as it relates to their family, occupation and recreational aspects of life.

We recommend our advisors use our W5 goal setting process with clients and include that document into the FORM tab within their PFO. This is a tangible and meaningful way to effectively make connections for the client as it relates to Family Investment Legacy and Transition issues, Occupational Retirement goals as well as Business Succession objectives, Recreational wish lists, etc - all of which become more predictable when tied into the solutions you provide.

When the Why is Clear, the How is More Appreciated

When you and your clients are crystal clear about all the reasons why they want to achieve financial independence, they place far more value on how you plan to get them there. This competitor-proofs your clients in a way that ensures that anyone trying to steal your clients will meet resistance and dead ends with every dripping effort.

And again, you get a double-win because the more your client buys-into your process and understands and appreciates it, the easier it will be for them to describe your process to someone else.

On that point, many advisors tell me that their clients have told them that they don't talk about money with their friends and family members. In truth what they are saying is that they aren't clear about your process or how endorsing you to someone will ultimately reflect back on them, or they are concerned that you will try to sell their acquaintance on buying an investment product and becoming a client. If that ever happens, use the misconception as an opportunity to re-frame their perception and start the process of helping them understand your commitment to stewardship rather than salesmanship. To accomplish that say something like this:

"Fair enough. The reason I'm asking is because a major component of my value proposition is in making myself available to act as a sounding board for friends and family members of my clients. They do not need to become a client of mine to take advantage of this service. Especially when it comes to family members because I have developed and refined a Family Investment Legacy Process for clients who are thinking about succession issues. So no worries if this isn't relevant or something you are comfortable with. I just want my clients to be aware that I will make myself available to be a sounding board for people who are important to my clients. Frankly it's the most fulfilling aspect of my job and one of the primary reasons I became a financial advisor."

Continued Success!

Contributed by Duncan MacPherson