Wealth Management Firm Valuation

What Is Your Business Really Worth?

"Every business is built to be sold" isn't just a saying. It's valuable advice for all business owners, including financial advisors and wealth management professionals.

A financial advisor's role is to be a life-long planner for clients - not merely a shortcut to build a nest-egg. That same planning philosophy extends to your own financial future, which inevitably includes the potential sale of your wealth management firm. Understanding your firm's valuation isn't just about planning an exit. It's about building a sustainable business that continually increases in value, whether you're considering succession planning today or years from now. For Registered Investment Advisors (RIAs) and financial planning practices, knowing how to properly value your business is the foundation of long-term success.

In this comprehensive guide, we will answer the most critical questions around wealth management firm valuation and succession planning:

- How do you accurately value a wealth management firm?

- What are current Firm or RIA Valuation Multiples?

- How do you prepare a financial advisor business for a sale?

- How would a financial advisor increase the value of their business?

- Financial Advisor Business Valuation Calculator Options

- Succession Planning for Financial Advisors; Which type of buyer is best for me?

- Traditional Buyers vs. Private Equity? Know Who You're Partnering With

- When is the optimal time to sell your financial planning practice?

- How to Sell Your Financial Advisory Practice Successfully & Ensure a Smooth Transition

Every investment of effort contributes to your enterprise value

While most business owners think about fundamentals like EBITDA, there is more that needs to be examined.

Consider all options when thinking about selling the business. Financial advisors should build out their intellectual property (IP), and document their systems, using a proprietary playbook. The playbook should encompass their approach to client management, investment strategies, financial planning and the goals and execution of the overall client experience.

Valuation by a third-party consultant is important, but these valuations provide an estimate, and may not give a perfectly accurate representation of market value, but it is a solid starting point. Taking the business to the market and seeing what offers arise is the only way to determine the true value. Someone will put an offer on the table. The market will reveal the truth.

How do you accurately value a wealth management firm?

Begin assessing the anticipated value of your practice by considering factors such as recurring revenue, client demographics, assets under management (AUM), and growth potential.

Consider the (T.O.P.) Framework: Tidy, Orderly, and Proprietary

- Tidy: How well-organized are your business operations and finances? Are your P&L statements clear, and do you track metrics like EBITDA?

- Orderly: Do you have contracts, agreements, and business structure documentation in place (e.g., employment agreements, client confidentiality, etc.)?

- Proprietary: What makes your practice unique? This could be a client acquisition model, branding, or a process or that only your firm offers.

Get a detailed checklist of these preparation steps when you reach out for a free consultation with JPTD Partners.

What are current firm or RIA valuation multiples?

In today's market, acquisition multiples vary considerably based on quality. Industry data shows that Revenue multiples for financial advisory practices generally range from 2.0x to 3.5x recurring revenue, with firms having higher percentages of fee-based, recurring revenue commanding premium valuations.

Premium Firm Revenue Valuations

Currently, higher quality firms command larger multiples based on revenue due to economies of scale, perceived stability, and broader service offerings:

- Sub $1M: Often capped at 4x (some buyers guarantee this)

- $1M-$2.5M: Around 5x

- $2.5M - $5M: Often 6x

- $5M+: Could hit 7x or more

Client Demographics and Valuation

The age and wealth profile of your client base significantly impacts your wealth management firm's valuation:

- Firms with younger clients (under 60) typically command premium multiples

- Practices with larger average account sizes often see higher valuations

- Client retention rates above industry averages positively impact RIA valuation multiples

- Established next-generation client relationships enhance succession planning value

Revenue Composition Effects on Multiples

The structure of your revenue stream directly impacts financial advisor book of business valuation:

- Fee-based recurring revenue is valued higher than commission-based income

- Diversified revenue streams reduce risk and can increase multiples

- Firms with growing financial planning fee components often receive premium valuations

How do you prepare a business for a sale? Factors that drive higher wealth management firm valuations

As you contemplate selling your business, maximizing the valuation "or multiples" will become your focus. Multiples are typically expressed as a factor of revenue or earnings, and are a key measure used by potential buyers to assess the value of a business. To achieve the highest firm or RIA multiples, you must strategically position your firm to appeal to buyers. In this guide, we'll walk you through ten tips to help maximize your multiples.

DOWNLOAD OUR MASTER CHECKLIST on preparing your business for a sale

How would a financial advisor increase the value of their business?

- Organic Growth - A strong growth trajectory shows buyers that your business is not only healthy but also scalable. Demonstrating that you can consistently bring clients into your practice organically can add a multiplicative effect on your practice. This may be from a social media system, a seminar system, or CPA alliances, but the key is that your practice can grow both up-and-down-market.

- 85% Recurring Revenue - Predictability is a key factor in valuation. Strive to have at least 85% of your revenue as recurring, such as fees from assets under management. High levels of recurring revenue reduce risk for buyers and often result in higher firm or RIA multiples, as they provide a steady and reliable income stream post-acquisition.

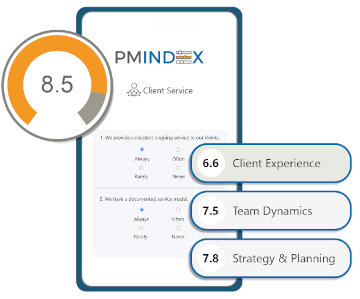

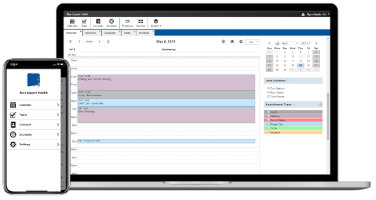

- Run it like a Business, Not Just a Practice - Transforming your practice into a well-run business is crucial. This involves establishing efficient processes, robust systems, and clear governance structures. Buyers are more likely to pay a premium firm or RIA multiple for a business with standardized operations and a professional management team, as it ensures continuity and scalability.

- G2 Leadership in Place - Having a second generation (G2) of leadership ready to take over is highly attractive to buyers. It reduces the perceived risk associated with the transition and ensures the longevity of the business. Groom your G2 leaders early, involve them in decision-making, and make sure they are well-known to your clients.

- Generational Strategy for an Older Client Base - If your client base skews older, develop a generational strategy that ensures continuity. Buyers will value planning that transitions wealth management to the next generation, retaining assets and relationships. This strategy should include engaging with clients' heirs and introducing services tailored to younger generations.

- Offer Comprehensive Financial Planning - A business that offers comprehensive financial planning, rather than just investment advice, is more likely to command higher multiples due to its deeper client relationships and diversified revenue streams.

- Own the Clients - If under an OSJ Model - If you are in an OSJ model where you receive overrides, it's critical to ensure that you own the client relationships. Ownership of clients' contracts directly impacts the valuation, as it guarantees that the buyer will retain control over these relationships post-sale.

- Desire to Stay Involved Post-Sale - Buyers often value continuity in client relationships and business operations. Expressing a desire to remain involved in the business for 5-7 years post-sale can significantly increase your multiples. This involvement ensures a smoother transition and mitigates the risk of client attrition.

- Clean Compliance Record - A spotless compliance record is non-negotiable. Any blemishes can drastically reduce your firm or RIA multiples or derail the sale altogether. Regularly audit your compliance procedures and address any issues promptly to maintain an impeccable record, which is a key factor in enhancing buyer confidence.

- Your Business is Systematized - Can you leave your business for two months and it will run just fine without you? Many advisors believe that their "holistic" form of financial planning or their money management system will add to the value of their business, but what's more important is that you have processes, systems, and procedures that ensure that the business can run just fine without you.

Financial Advisor Business Valuation Calculator Options

As a first step, learn what the estimated value of your wealth management firm is now. We recommend JPTD Partners' business valuation specifically designed for financial advisory practices: Get my wealth management firm valuation

Other valuation resources for RIAs and financial planning practices include:

- Industry-specific business valuation calculators that account for AUM, revenue mix, and growth rates

- Professional business appraisers with experience in wealth management firm valuations

- Broker-dealers and custodians that offer valuation services to affiliated advisors

Remember that while calculators provide useful estimates, they cannot account for all the qualitative factors that influence your wealth management firm's true market value. A comprehensive valuation should include both quantitative metrics and qualitative assessments.

Succession Planning for Financial Advisors: Which type of buyer is best for me?

Partial vs. Full Sale: What's the Right Path for You?

When it comes to transitioning your financial advisor business, one of the first strategic decisions is whether to pursue a partial sale or a full sale. There's no one-size-fits-all answer it's about clarity on your goals and what the next chapter looks like for you.

A partial sale typically means bringing on a strategic or financial partner while retaining some ownership and staying involved in the business. This route can be a great fit for advisors who still have gas in the tank, want to scale, and are open to leveraging outside capital or expertise. You get to take some chips off the table now while staying in the game for a second, potentially larger, bite at the apple. The trade-off? You're no longer the sole decision-maker so alignment on vision and values becomes critical.

A full sale, on the other hand, is a clean break"100% ownership transitions to the buyer. This is ideal for advisors looking to fully exit, perhaps for lifestyle reasons or retirement. It delivers maximum liquidity and clarity, but it also means letting go of future upside and influence over the firm's direction.

The key is to succession planning is to begin with the end in mind: Are you looking for growth and continued involvement or a well-earned transition and peace of mind?

Traditional Buyers vs. Private Equity: Know Who You're Partnering With

Not all buyers are created equal. When selling your practice, the type of buyer traditional or private equity can dramatically shape what the deal looks like and how your legacy carries forward.

Private Equity (PE) buyers are financially driven and laser-focused on return on investment. They're looking for scalable businesses with predictable cash flow, and they often bring capital, infrastructure, and professional management into the mix. These deals frequently involve rollover equity meaning you stay on with a minority stake and participate in a future sale. It's a more institutional approach, with reporting structures, performance benchmarks, and an eventual exit strategy.

By contrast, traditional buyers think other advisory firms or individual practitioners are often looking for fit over formula. Their focus is on long-term integration, cultural alignment, and client continuity. These buyers typically bring more flexibility in a deal structure and may be more sensitive to preserving your client experience and team dynamics.

So, What's the Play?

- PE = Scale, systems, second exit.

- Traditional = Synergy, stability, long-term stewardship.

The decision ultimately comes down to what matters most to you: financial optimization, legacy preservation, lifestyle, or some mix of all three. This is where clarity is power when you know what you want, the right partner becomes easier to spot.

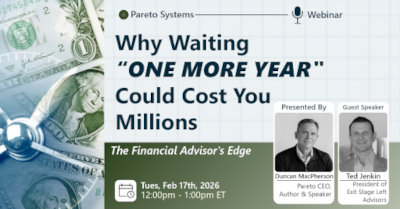

When is the optimal time to sell your financial planning practice?

A Strategic Playbook for Financial Advisors Ready for Succession Planning

If you're considering selling your financial planning practice, timing isn't just a matter of the calendar-it's a matter of strategic alignment. The "when" behind a business transition can either enhance enterprise value or leave opportunity on the table. The best advisors know that successful transitions are built on proactive succession planning, not reactive decisions.

Begin With the End in Mind

Let's start with the most important question: What does life look like after the sale?

This isn't just about retirement - it's about relevance, legacy, and lifestyle. Many financial advisors underestimate how closely their identity is tied to their business. If you sell too soon, you risk feeling untethered. Wait too long, and your enthusiasm - and your business performance - may wane. Ideally, your decision to sell is based on pull factors (what you're moving toward), not push factors (what you're escaping from).

That's why timing starts with self-awareness. What do you want next? And how will your business support that outcome?

Build a Business that's Transferable, Not Just Successful

A business that's valuable to you isn't always valuable to a buyer. That's a tough pill for some to swallow. If the firm is too dependent on you personally - for rainmaking, for client relationships, for operational knowledge - the transition risk for a buyer goes up. So does the discount.

Buyers pay a premium for structure, predictability, and a smooth handoff - download our Checklist. They're buying future cash flows, not just past performance. So focus now on systematizing processes, documenting client service models, and nurturing your next-gen team, if you have one. Treat your business like an asset, not a job. That shift alone changes the conversation around timing.

Time the Market Without Timing the Market

We're not in the business of making speculative bets - and neither should you be when it comes to M&A. But you should be aware of market cycles. Right now, the demand for advisory firms is strong. Interest from consolidators and professional buyers continues to push firm and RIA valuation multiples up, especially for firms with recurring revenue and clean compliance.

However, markets are cyclical. Multiples compress when rates rise or when capital dries up. And tax laws can shift without much warning. You don't want to look back and realize you missed the window. The key is to be ready before you need to be.

Position for the Win-Win

A transition done well benefits all parties: you, your buyer, and - most importantly - your clients. Client continuity is the currency of a successful deal. If your clients aren't bought into the transition, the deal won't hold.

Start planting those seeds early. Communicate with transparency. Align yourself with a buyer who shares your values and delivers continuity of you process and service. That's not just about securing a deal - it's about protecting the trust you've spent years building.

How to Sell Your Financial Advisory Practice Successfully & Ensure a Smooth Transition

For a financial advisor, the decision to sell your practice is both personal and professional. It's not just about monetizing years of hard work; it's about protecting your legacy and ensuring your clients are in good hands. To execute this transition effectively, you need a client-first mindset and a process-driven approach. Here's how to break it down into three essential components: Client Transition, Lock in Value with Process, and Ensure Continuity.

Client Transition - Be the Advocate When Selling Your Firm or RIA

The client relationship is the beating heart of your wealth management business. When it comes time to transition those relationships, your role shifts from advisor to advocate. You're no longer just managing wealth - you're managing expectations, emotions, and trust. The goal is to help clients go from initial uncertainty to complete confidence in the new advisor.

Start by segmenting your book. Identify your most engaged and high-value clients, and initiate personal, high-touch conversations with them. Frame the transition around their needs: "I've found someone who shares our philosophy and will continue to elevate your experience." The key here is to be intentional, not reactive.

Ideally, introduce your successor well before the handoff. Use collaborative meetings, joint planning reviews, or even informal coffees to allow organic rapport to develop. This isn't just about the buyer earning trust - it's about you transferring it.

Lock in Value with Process: Build a Wealth Management Firm, Not Just a Book

When buyers evaluate your business, they're not just buying revenue - they're buying structure. A practice that relies heavily on you personally will be discounted. A business that runs on well-documented processes is scalable and transferable - and that's where real value is unlocked in firm and RIA valuation multiples.

Audit your operations. Do you have documented client engagement models? Are your CRM and compliance systems up to date and easy to navigate? Have you codified your onboarding, review, and communication protocols?

Think of it like this: your practice should be turnkey. A buyer should be able to step in and replicate your client experience without starting from scratch. That's how you move from selling a "job" to selling a business that commands premium multiples.

You can bring in experienced professionals to support valuation and deal structure. A third-party consultant can provide objective insights, help you avoid blind spots, and ensure the value you've created is fully captured.

Ensure Continuity - Finish Strong

Continuity is where you cement your legacy. Most successful transitions involve a defined handoff period - 6, 12, maybe even 24 months - where you stay involved to help clients (and staff) navigate the change. Clarity is king. Be specific in the transition agreement: outline your role, responsibilities, compensation, and duration. The fewer assumptions, the better. This period is about reinforcing the new advisor's credibility while reassuring clients that they're still in expert hands.

Don't forget your team! Your staff plays a critical role in the client experience. They need to feel secure, appreciated, and aligned with the incoming advisor. If they're engaged, they'll help anchor the transition.

A business transition is not just a financial event - it's a professional crescendo. Approach it with the same discipline, care, and client-first philosophy that built your success in the first place. When you finish strong, you elevate everyone involved: your clients, your successor, your team - and yourself.

Final Thoughts on Financial Advisory Practice Valuations

Great wealth management firms are bought, not sold, but only when the advisor prepares accordingly. If you view your business through the lens of enterprise value-and you align your exit with your ideal future-the question of timing becomes far less daunting. It becomes part of the strategy. Our key takeaways:

- Know your numbers: Understand your firm's financial metrics, particularly recurring revenue, EBITDA, and client demographics, as these drive RIA valuation multiples.

- Build transferable value: Focus on creating systems, processes, and team structures that reduce dependence on you personally.

- Optimize your client base: Work to lower the average age of your client base by developing relationships with next-generation family members.

- Clean up your operations: Ensure compliance records are spotless and business documentation is organized and accessible.

- Consider your ideal exit: Determine whether a partial or full sale aligns with your personal and professional goals.

- Start succession planning early: The most successful transitions are planned years in advance, not months.

Ready to take the next step in understanding your wealth management firm's value? Contact us today for a personalized consultation on maximizing your practice's worth.

Financial Advisor Coach | Author | Speaker