The Franchise Ready Advisor

From Sustainability to Scalability

The next natural step for a successful financial advisor to take once they have achieved consistent, sustainable organic growth is to then consider scalable, acquisition growth.

More and more we see top professionals transform their proven best practices into intellectual properties that can be deployed over and over again. This is what it means to turn a book of business into an actual business that has no limits while achieving steadily improving enterprise value.

From Working IN to Working ON Your Business

Bestselling author Micheal Gerber captured this premise beautifully in his book The E-Myth.

The core premise is that an entrepreneur must shift from having a job where they sell something (ultimately trading time for money) to building something that has many multipliers in terms of efficiency and value. It's easy to get bogged-down in "busyness" transacting services rather than building a business that puts you on a track to a meaningful and measurable inflection point.

A Force of Nature

If franchise-readiness is something you've been considering, allow me to remind you of something that supports why your timing is impeccable - demography.

There is a massive group of current advisors who are 5 years out or less from an exit. This community is thinking about how to take at least some money of the table or to fully monetize the equity value of their business. And the truly enlightened also want to ensure their clients are well taken care of once a transition takes place.

Interestingly there is essentially a "2 for 1" benefit to this reality. You see there are also many clients of financial advisors who have their own continuity and succession issues too. When someone becomes financially independent at that moment the burden shifts from "will I have enough?" to "what becomes of my legacy?" Who better to become indispensable to that client with a new unmet need than an advisor who has addressed it himself or herself in real time?

But it gets even better. In addition to the many advisors who are on the home stretch, there are 2 other addressable markets as well. First, you have a large group of advisors who aren't looking to leave the business but are frustrated by the friction that compliance and commoditization present. This group longs to draft in behind an advisor with turnkey and all encompassing procedures that liberate them to do what they enjoy - interacting with clients and not getting bogged down in the minutiae.

Thirdly you have the advisors who want to transition to a work-optional lifestyle and decide to disassociate from a large block of clients to focus on a smaller group of ideal clients while pursuing other interests in life. It's common to see a process-driven advisor acquire remnants of clients and squeeze a lot more juice out of the orange through an elevated client experience. Just the other day I spoke with an advisor who acquired 10 million dollars of cast-away clients and turned that vein of gold into 15 million in 30 days! A methodical transition and reframing process prompted his newly onboarded clients to say, "Where have you been all my life? This is a dramatic upgrade!" Granted the bar may have been low based on neglect by the former advisor but the elevation and lift were both immediate and measurable.

Prime the Pump

So where does as an aspiring franchise-ready advisor start? To paraphrase Michael Gerber again, "Every business should be built to be sold for maximum value even if you have no intention of selling it."

In other words, get out in front of franchise readiness even if the only benefits are competitor-proofing your existing clients and restoring liberation amd order to your life. Then decide if you want to deploy your scalable growth model.

Convergence and Conversion

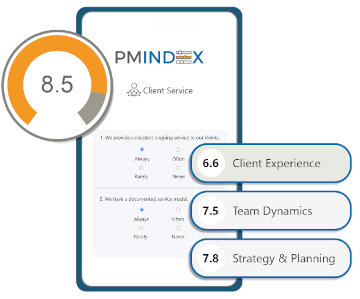

Those two words are like true-north to the franchise-ready advisor. Convergence means that you get everything out of your head and document it in a duplicable playbook. If what you know resides in your head it is a commoditized skill. If it's documented it is a repeatable intellectual property.

At Pareto Systems we follow The Rule of 3 - anything you do 3 or more times that has 3 or more steps must be invested into your playbook so that no one is ever left to their own devices reinventing the wheel. Maverick talent transitions to predictable and consistent execution.

The framework of the playbook is broken into 3 core components:

- The Wealth Management Process - everything to do with deliverables around your core solutions and competencies

- The Practice Management Process - everthing to do with operations, standard operating procedures and the client experience

- The Relationship Management Process - everything to do with how you articulate and communicate your value so that clients fully and completely understand and appreciate your value

Remember, you don't just manage money. You manage a business and you manage people - all three are of equal importance to your playbook.

Subscribing to our "Done is better than perfect" mindset, most of our teams get 80% of the playbook done in 90 days. That is the red zone and getting home from there is inevitable.

As you shift from cobbled together deliverables to a converged and integrated process, you then have to shift to a mindset of conversion. Simply stated you have 3 types of clients:

- Customers who dabble with you but don’t empower you fully

- Clients who empower you fully but don’t send referrals

- Advocates who are the dream client

A major part of the reframing process involves going back to existing clients and essentially reintroducing yourself and your value so they have the complete picture and see the merit of converting from customer to client to advocate.

We all know the power of entropy - nothing improves through neglect. And it's not as if neglect is conscious. Long term relationships are susceptible to The Law of Familiarity which states that over time value can be taken for granted or trivialized. This is where loyalty fatigue is born.

Partner With Pareto

If you aspire to become a franchise ready advisor why not buy-into our proven process rather than reinvent the wheel. Not only can we methodically make you franchise ready but we can even shine a light on your success and showcase you to the many thousands of advisors in our community. Start by contacting us and going through an initial gap analysis and together we can determine if there is a good fit.

Continued Success!

Contributed by Duncan MacPherson