Grow Your Divorce Advisory Business

5 Strategic Steps From Niche to Notable

As a financial advisor who specializes in divorce, you've carved out a unique and valuable niche, often for deeply personal and empathetic reasons. Maybe you've seen a loved one struggle through a financially devastating divorce, or you've recognized how underserved women are during this emotionally and financially turbulent time? You understand that beyond spreadsheets and settlements, your role is about helping women reclaim clarity, stability, and control. This work sets you apart, but it doesn't automatically translate into a thriving, scalable business. Many advisors find that growing their practice requires more than technical knowledge, it demands a clear strategy, intentional systems, and effective marketing. Unfortunately, these are exactly the areas where challenges begin to pile up.

One of the first issues financial advisors face is the lack of a clear, actionable growth strategy. According to a 2023 Financial Planning Association (FPA) study, over 60% of financial advisors admit they don't have a formal business plan. Many rely on referrals and organic word-of-mouth, hoping their reputation will do the heavy lifting. Without a roadmap to guide decisions and focus efforts, though, growth becomes inconsistent and unpredictable. Even advisors with a well-defined niche like divorce planning often struggle to articulate their value proposition in a way that connects with prospective clients. Compounding the problem, only 26% of advisors say they consistently track key performance indicators (KPIs), making it difficult to identify what's working, and what's not.

Marketing is another stumbling block. Advisors frequently deal with low brand awareness, especially within niche markets. A 2022 Kitces Research report showed that advisors spend an average of just 8.6% of their time on marketing activities. They know their specialty is valuable, but they don't always know how to communicate that value effectively, or get it in front of the right audience. Since most advisors aren't trained marketers, those who attempt to run campaigns often do so inconsistently or without a clear framework. This leads to messaging that feels generic, blending in with every other financial advisor instead of standing out as a go-to expert in divorce planning.

Operationally, many advisors encounter inefficiencies that make scaling difficult. Practices that aren't built on repeatable, scalable systems eventually hit a wall. A 2021 Investment News survey found that more than half of advisors say they're operating at or near capacity, which leaves little room to take on new clients or pursue growth initiatives. Time management becomes a daily struggle, with advisors spending the majority of their energy working in the business - handling client work, managing compliance - rather than on the business. Often, everything depends on the advisor personally, making it nearly impossible to expand the business or delegate critical functions.

Client acquisition and retention come with their own set of problems. Even when advisors attract leads, they may struggle to convert them into clients because the sales process isn't refined. In other cases, unclear or overly broad messaging leads to attracting clients who aren't a fit for the advisor's services or personality. For advisors focused on a sensitive niche like divorce, client expectations can be especially high - and without systems in place to support that level of care, the pressure becomes overwhelming. In fact, data from Cerulli Associates shows that 72% of advisors say managing client expectations is one of their biggest challenges.

Finally, there are internal challenges related to confidence and mindset. Many advisors, even the highly competent, feel unqualified to scale their business or be seen as thought leaders. Some hesitate to embrace their niche, worried that focusing too narrowly might limit opportunities rather than open doors. There's a reluctance to delegate or outsource, which keeps them stuck in a cycle of overwork and underperformance. Research from FP Transitions indicates that solo advisors, who make up over 60% of the industry, are most susceptible to burnout and stalled growth because they try to do everything themselves.

All of these issues compound to create a complex web of obstacles, making growth feel elusive - even for advisors with deep expertise and a clear niche. Addressing these challenges requires more than technical skill; it demands a shift in mindset, operations, and strategic focus.

Join the Pareto Mastermind on Divorce-Focused Practices

Case Study: A Divorce-Focused Financial Advisor Practice

Dave is a financial advisor who is a coaching client of mine. Before we got together, Dave decided to make his business all about helping divorcing women. He was somewhat successful in attracting clients, but he wanted to build a predictable and scalable business.

When he first came to speak with me, I noticed his web site was filled with pictures of big buildings (he worked in a large urban setting) and lots of people in suits around desks, whiteboards and tables. Very professional and very corporate looking. His site talked about his portfolio management and tax expertise. Buried on a subsidiary page, he spoke about his expertise in working with divorcing women. He had testimonials from some very successful clients (all men) and the link to his divorce page was actually broken. This needed attention.

When I asked him for his marketing material that he used to demonstrate his commitment to the area of divorce, he admitted that he didn't have one.

While he knew he wanted to work with divorcing women (and really had a strong commitment) he could not identify his ideal client. Though he wanted to scale, his business was a mess both in terms of client experience and operationally.

Fast forward three years the story has changed dramatically. The proof: Dave's business is organized, process-based, and is attracting 4-5 new ideal clients on average, per month. And growth is accelerating.

As a coach and consultant to many financial advisors working in the divorce space, I've helped professionals like you grow their businesses exponentially. The following 5-steps are proven to help you expand your reach, attract more clients, and scale your practice with purpose.

1. Define and Understand Your Ideal Client

One of the most important steps in growing a divorce-focused financial advisor practice is clarity on who your ideal client is. A common pitfall that many advisors fall into is trying to serve everyone. When you try to be everything to everyone, it becomes difficult for potential clients and referral partners to understand exactly what you do and who you do it for.

Specializing in divorce planning gives you a clear and defined audience, but it's still essential to further narrow down your ideal client. Are you focusing on individuals who are going through a high-net-worth divorce? Or are you more interested in helping individuals with more modest financial situations? Maybe you specialize in helping women navigate divorce, or you work with clients who are near retirement age.

The more specific you can be about who you want to serve, the easier it will be to tailor your services, marketing, and referrals to that group. Additionally, when you're clear on your ideal client, you become a magnet for the right type of person. The clients who need your expertise will be able to find you easily, and your messaging will resonate with them.

Strategic partners - such as divorce attorneys, mediators, and therapists - will also appreciate knowing exactly who your ideal client is. When they understand who you work best with, they'll feel confident introducing clients to you, knowing you can help them effectively.

Action Step: Thoroughly review your existing clients and identify those you like the most, those who are most profitable, and those who are your best fans. Write down all you can about them and then turn this into an ideal client profile.

2. Get Organized For Growth

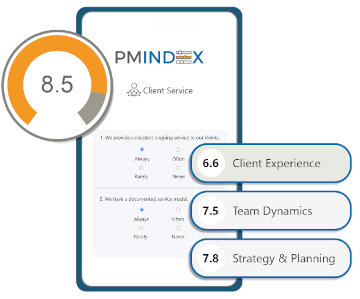

As your practice grows, it's important to ensure that your operational processes are in place and running smoothly. Without solid systems and structure, the growth you experience can become overwhelming, leading to mistakes, missed opportunities, and dissatisfied clients.

Clearly documented processes is crucial for delivering a consistent and high-quality experience to your clients. Review and document your client fit process, your onboarding procedures, and the steps involved in delivering your ongoing client experience. Without these processes, important details can slip through the cracks, and your ability to scale will be compromised.

By organizing your operations and streamlining your procedures, you can ensure that growth is manageable, and that you continue to provide excellent service to every client.

Action Step: Start by auditing your current systems. Is your client intake process seamless? Does your onboarding process set expectations clearly for both you and your clients? Do you have a follow-up system to keep clients engaged after the divorce is finalized? If not, this is a great place to start!

3. Build a Prospective Client Fit Process

It's essential to have a defined "fit" process that helps you determine whether a potential client is right for your services and expertise. This is particularly important in the divorce space, as not every individual going through a divorce will be a suitable client for your practice.

A strong client fit process not only helps determine whether you can help a client, but also whether you should help a particular client. This also enhances your relationships with your strategic partners. By being clear with them about who your ideal client is, you can avoid taking on clients that aren't a good fit for your services.

When potential clients are not a good fit, don't hesitate to turn them away. It may feel uncomfortable at first, but a strong "fit" process will allow you to have those difficult conversations without damaging relationships. Additionally, it's important to have alternatives in place, such as referring clients to other advisors who may be a better solution for their needs.

Your reputation is built on providing value to your clients, and by working with clients who align with your expertise, you are better able to deliver the best possible service. A strong fit process not only helps you avoid wasting time on unsuitable clients, it also builds trust with your strategic partners, who will appreciate your professionalism in knowing when to refer clients elsewhere.

Action Step: Outline a process that begins with the first contact all the way through the start of your onboard process in a way designed to weed out those who are not a good fit, and secure those who are.

4. Align Your Marketing Efforts With Your Niche Divorce-Focused Practice

Generic marketing won't work. To truly stand out, your marketing should clearly communicate your specialization in divorce financial planning. This is where focusing on your niche can make a huge difference.

When potential clients land on your website or receive your marketing materials, it should be immediately clear that you specialize in divorce. Don't be afraid to be "loud and proud" about your niche. Let your audience know that your expertise lies in helping certain individuals navigate the complex financial landscape of divorce. Make it obvious in all your marketing materials, website, brochures, and social media.

This doesn't mean you can't work with other clients, but it's important that you communicate who your ideal client is, and why you're the best person to help them. You can still serve other markets if you choose, but your marketing should focus on your divorce specialty, as this will attract the clients who need you the most.

Action Step: Look at your website and marketing materials from a potential client's perspective. Are you clearly presenting yourself as a divorce expert, or do your materials look generic? If your marketing doesn't specifically address the needs of divorcing clients, it's time to update it to better reflect your focus.

5. Develop And Maintain Strategic Partnerships

One of the most powerful ways to grow your divorce practice is by developing and maintaining strategic partnerships with professionals that understand the emotional dynamics and unique complexities of divorce. These are the professionals - attorneys, mediators, therapists, and even other financial advisors - who work with clients going through divorce and can refer clients to you.

Strategic partners are a valuable source of high-quality leads, so it's essential to have a clear process for building and nurturing these relationships.

Action Step: Make a list of all your existing relationships. Identify what you know about them that you could use to amplify your relationship (birthdays, hobbies, etc.) Build out a service matrix that you can use with each relationship to stay top of mind (dinners, activities, cards etc.) Then make a list of other potential partners you would like to know and start to communicate with them, email, LinkedIn, etc. to start to build relationships with them.

Bonus: Design For Client Advocacy

Client advocacy is one of the most powerful tools for growing your practice. If your clients are satisfied and confident in your expertise, they can become a solid source of referrals.

The key to client advocacy is ensuring that your clients fully understand your process and feel comfortable sharing it with others. This means having clear communication about what you do, who you help, and how you can assist in the divorce process. When clients feel empowered to share your message with others, they are more likely to introduce their friends, family, or colleagues in need of your services.

Action Step: Ask your best clients how they describe you. If they say they trust you, that's good, but it is just a starting point for effective messaging. Make sure they understand and can explain your process and your full value.

Building a successful divorce financial advisory practice is about more than just knowing the financial details of divorce. It requires a thoughtful, strategic approach to attracting the right clients, creating strong systems for growth, and building meaningful relationships with other professionals.

By following these steps - defining your ideal client, organizing your processes, building a fit process, aligning your marketing with your niche, and cultivating strategic partnerships - you can build a thriving practice that not only helps clients but is also positioned for sustainable growth.

Now is the time to take action and implement these steps to ensure your practice is set up for long-term success. The divorce space is full of opportunities, and with the right strategy in place, you can tap into this growing market and make a lasting impact.

If you would like to schedule a 30 minute call to discuss your situation, or learn how coaching or a mastermind group could help you, please reach out here

----------------------------------------------------------------------------------------

Scott Hamilton

Scott is a seasoned professional consultant and business advisor, with extensive experience helping advisors grow and scale their advisory businesses.

Over the years he has worked as an attorney and consultant in the areas of divorce, high net worth, business exit, and tax, bringing that wealth of experience to his coaching and mastermind groups.

His clients range from solo advisors to multi-advisor teams, including a number of multi-billion-dollar teams.

Scott has been a certified Pareto Systems coach for 8+ years and leads mastermind groups for Pareto Systems in the areas of divorce, M&A, exit planning, the "Road to a Billion," and others.

Scott is married to Kim Hamilton (30+ years) with a large contingent of children and grandchildren.

In addition to many family activities, Scott spends much of his free time playing guitar and songwriting.

Join Scott's Divorce-Focused Mastermind