Scaling vs. Monetization:

The Systems Advisors Need to Build Enterprise Value & Plan an Exit

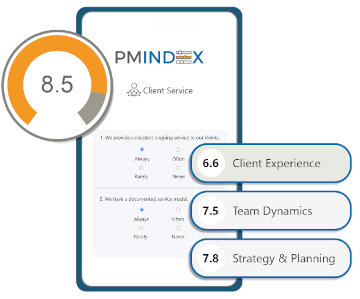

Scaling a financial advisory business requires more than just working harder, it demands strategic systems to drive efficiency, client engagement, and long-term enterprise value. But many advisors stop at growth and never fully optimize their practice for monetization or an eventual exit.

The biggest mistake advisors make? They wait too long to think about valuation. Many assume they'll sell their practice in the future, but by the time they're ready, they're either unprepared or they undervalue what they've built. Without systems in place, branding, client engagement, operational efficiency, your practice may not be worth what you think it is.

In this clip, Peter Velardi and I discuss the difference between scaling and monetization, and how systems make all the difference. We cover how advisors should position themselves for maximum valuation, why branding and operational efficiency drive enterprise value, and why selling your practice is more complex than you think.

Watch now to learn:

" The key difference between scaling and monetization in financial advisory

" Why branding matters once you hit the scaling phase

" The biggest valuation mistake advisors make before exiting

" How to structure your business to stay in control of your timeline

" The power of strategic systems to make your business more sellable

This clip is an excerpt from episode 74 of the "Always On with Duncan MacPherson' financial advisor podcast featuring Peter Velardi, founding partner at JPTD Partners. Stream the entire episode on your favorite podcast channel:

Apple Podcasts: paretosys.co/ao_ap

Spotify: paretosys.co/ao_sp

Find Your Channel: paretosys.co/ao_bb