Where the Pareto Principle Came From

(also known as the 80/20 rule)

I've understood the Pareto Principle for years, but what strikes me is how often it reveals itself in the day-to-day reality of the advisors we work with. No matter the practice size or business model, the pattern is there: a small percentage of clients consistently drive the majority of revenue and advocacy. 80% of revenue is, more often than not, derived from 20% of the clients. From the same perspective, the advisors dedicate only 20% of their time to the clients that drive 80% of the business.

I see the same dynamic play out in other areas. A few key processes, or lack thereof, can create the majority of bottlenecks and capacity issues. A handful of strategic partners generate most of the introductions. And it doesn't stop at the professional level. The 80/20 pattern shows up everywhere once you're looking for it. A short burst of effort produces most of the progress. A small number of decisions influence the bulk of our outcomes. A handful of habits (good or bad) that end up shaping most of our lives.

The more you observe it, the clearer it becomes. The 80/20 rule isn't just a productivity concept, it reveals where advisors gain momentum and where they lose it. Which naturally leads to the exploratory question: Where did the Pareto Principle originate? And, why does this pattern show up so consistently in financial services?

In this article we will cover:

- Why the 80/20 Rule Still Matters

- Where the Pareto Principal came from

- Why the 80/20 Rule Shows Up Everywhere in Financial Services

- How to Use the Pareto Principle in Practice Management

- Why the Pareto Principle Resonates with Financial Advisors

WHY THE 80/20 RULE STILL MATTERS

Financial advisors are navigating a world of constant information, rising client expectations, and tighter competition. That makes strategic focus more important than ever. One of the simplest and most powerful frameworks to help maintain that focus is the Pareto Principle, more commonly known as the 80/20 rule.

At its core, the principle suggests that roughly 80% of outcomes come from 20% of inputs. It's not a hard-and-fast rule, but a pattern that shows up in business, productivity, client relationships and most other fields.

For advisors, applying the 80/20 rule can clarify:

- Which clients drive the most value

- Which marketing channels actually convert

- Which operational tasks drain most of your time

- Which planning activities create the greatest impact

WHERE THE PARETO PRINCIPLE CAME FROM

Vilfredo Pareto: The Economist Who Wasn't Trying to Teach Us Productivity

It all began with Vilfredo Pareto, an Italian economist in the late 1800s. Pareto wasn't trying to optimize anyone's workflow. He wasn't thinking about client segmentation, staff allocation, or anything remotely connected to productivity.

In 1896, he simply noticed something odd: 80% of Italy's land was owned by 20% of the population.

Then he saw the same pattern in other countries throughout Europe, and in different time periods. It was like history was quietly whispering the same message over and over.

Pareto wasn't interpreting it as the 80/20 rule at the start. He was just documenting an imbalance that seemed to exist everywhere.

The Pareto Principle isn't unique. The principle is a power law, like many others. Put simply, a power law (in statistics) is, to paraphrase Wikipedia:

"A relationship between two quantities, where a relative change in one quantity causes a relative change in the other quantity - proportional to the change - raised to a constant exponent: one quantity varies as a power of another."

As a simple example, a square's area is the square of its side. A 2" square is 4 square inches. If you double the length of a side to 4", you increase the area to 16, the square (power of 2) of the side. The relationship of a square's area to its side length is an example of a power law.

We all are familiar with a hockey-stick graph. That's what this is. Pareto's genius was noticing the power law applied to real-world socioeconomic relationships, not just math and physics.

Joseph Juran and the "Vital Few"

Fast forward a few decades.

Enter Joseph M. Juran, a quality management expert who took Pareto's observation and gave it a new life.

Juran discovered that in manufacturing, a small handful of defects caused the vast majority of problems. He called these the "vital few", the small number of factors that drive the majority of results (or headaches).

This was the pivotal shift. Juran effectively turned Pareto's economic curiosity into a usable principle for:

- Operations

- Leadership

- Strategy

- Productivity

And, eventually, for financial advisors and the business of advice.

WHY THE 80/20 RULE SHOWS UP EVERYWHERE IN FINANCIAL SERVICES

One thing we see, our industry is inherently unbalanced. No matter how long you've been in the business, you'll notice that a handful of factors drive the majority of your outcomes. It shows up in places like:

- Client profitability

- Referral flow

- Investment results

- Team output

- Operational mistakes or bottlenecks

This isn't a flaw in your practice. It's the natural shape of the work we do. That's why the Pareto Principle shows up so consistently in financial services.

I still remember an advisor we worked with. Let's call him Chris. He had a book of about 260 households and felt like he was spinning his wheels trying to serve everyone equally. When we mapped out the numbers, it turned out that 23 clients generated nearly 78% of his total revenue, and those same clients were the ones sending the most introductions. Chris wasn't underperforming, he was just spreading his energy in a way that didn't match the reality of his business. Once he saw the pattern, everything changed. He restructured his service model, redirected his team's time, and focused on his top relationships. Within eighteen months, his practice grew faster than it had in the previous five years.

This is the power of recognizing 80/20 patterns. Once you see them, you can start allocating your time, attention, and resources with intention. When you do, the business gets lighter, more profitable, and a lot more fun to run.

The Pareto Principle isn't just a Theory - it's a Lens

When you start seeing your business through it, you can focus on the work that moves the needle, reduces stress, and helps you build a practice that grows on purpose rather than by accident.

HOW TO USE THE PARETO PRINCIPLE IN PRACTICE MANAGEMENT

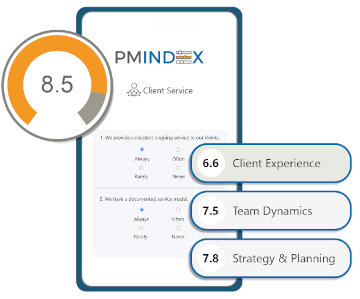

1. Smarter Client Segmentation

One of the first things we tell advisors is this: if you don't intentionally segment your clients, you will accidentally treat everyone the same. In a business where client value varies dramatically, that's a recipe for burnout.

The 80/20 rule gives you a clean, objective way to create clarity and scarcity. It helps you:

- Pinpoint your highest-value 20%

- Design meaningful service tiers (A, B, C clients)

- Align your team and technology with the real workload

- Explore alternative models for lower-tier clients, like digital planning tools or scaled-back service packages

Segmentation isn't about treating people unfairly. It's about making sure your best clients receive your best energy.

We once coached an advisor who prided himself on being "equally responsive" to all 300 of his households. On paper, that sounded noble. In reality, he was drowning; working late nights, missing growth opportunities, and unintentionally shortchanging his top clients.

When we ran his segmentation analysis, he discovered that 274 households accounted for just under 32% of his revenue and referrals, but ate up more than 3/4 of his time. That realization hit him hard. He built clear service tiers, retooled his calendar, and shifted smaller accounts to a lighter-touch model supported by his associate advisor.

Three months later, he said, "I'm delivering better service to the clients who matter most - and I'm not exhausted anymore."

That's the power of segmentation done right. It frees you to deliver your highest-value work to your highest-value relationships.

2. Deepening High-Value Client Relationships

One thing we emphasize to every advisor we coach is this: your top 20% of clients are the engine of your entire practice. Even small upgrades in how you serve your top clients can create big returns.

One advisor we worked with had built an impressive book, but she treated every client interaction the same way; same meeting cadence, same agenda, same follow-up process. When we analyzed her client base, we found that 22 households were driving nearly all her growth and 90% of her referrals.

She decided to pilot a "white-glove" experience just for these top clients: an extra planning review each year, a custom check-in schedule, and dedicated meetings with adult children. Within six months, those enhanced relationships produced five high-quality introductions, without her asking for any.

She told us later, "I didn't realize how hungry my best clients were for deeper planning until I actually showed up with it."

That's the magic of the top 20%. A small investment of effort can transform both your client relationships and the trajectory of your practice.

3. Leaning Into Your "Vital Few" Referral Advocates

One of the biggest lightbulb moments advisors experience in financial advisor coaching is when they realize that most of their introductions come from a surprisingly small circle of enthusiastic advocates. It's rarely the whole client base. It's the vital few who genuinely believe in your work and naturally talk about you. To make the most of this, focus on:

- Identifying your strongest referrers

- Staying in warm, consistent contact with them

- Equipping them with simple, natural language they can use when talking about you

- Making sure your onboarding process makes new introductions feel welcomed and valued

And here's the shift that changes everything: Position an introduction as a service you provide, not a favor you're asking for. Clients feel more confident making introductions when they see it as helping the people they care about, rather than doing you a personal favor.

A financial advisor we coached was frustrated that referrals had stalled. When we dug in, we realized he had three clients who were responsible for almost every introduction he'd ever received, but he had never clearly communicated his process with them.

We tested a small change. He began telling these clients, "If someone in your circle is unsure about their retirement direction, feel free to connect us. I'm happy to be a sounding board, even if they never become a client." Suddenly, giving an introduction felt easy and low-pressure.

Within a month, one of those advocates sent two new introductions; both a great fit.

That's the power of engaging your top referrers with clarity and intention. When you give your best advocates something simple and natural to say, and you follow it with a strong onboarding experience, introductions stop feeling random and start feeling reliable.

4. Fixing Operational Bottlenecks

Operations may not feel glamorous, but they follow the 80/20 rule just as faithfully as marketing or client service. In almost every practice we've coached, it's the same pattern:

- A handful of processes create the majority of delays

- A few recurring errors cause most compliance issues

- One or two systems create most of the workflow friction

The key is not to tear everything apart. It's to find and fix the vital few issues that slow everything else down.

Even small improvements can produce an outsized lift in efficiency.

We once worked with a firm that felt like it was constantly "busy" but never actually gaining traction. Their advisors were frustrated, their support team was overwhelmed, and tasks were piling up in their CRM like laundry.

When we traced the problem back, we discovered that one step in their account-transfer process was responsible for nearly 30% of all outstanding tasks. One step! The team was sending forms back and forth because signatures were collected inconsistently, which triggered compliance snags and delays.

We fixed that single workflow: Created one clean checklist, automated part of the form process, and clarified who owned each step. Within three weeks, their backlog was cut in half.

That's the hidden power of the 80/20 rule in operations: you don't need a massive overhaul. You just need to fix the few things that matter most. Once those bottlenecks are gone, the whole machine starts running smoother - and everyone's stress level drops immediately.

5. Prioritizing the Work That Actually Moves the Needle

Advisors juggle a mix of client meetings, planning, admin work, and business development. But here's the truth we remind every financial advisor we coach: Not all tasks deserve equal attention. In fact, your success usually comes from a small handful of high-value activities; your "top 20%."

We coached an advisor who spent the first hour of every day "getting organized," which really meant wrestling with email and paperwork. When we tracked her time for a week, we found that only 28% of her time was going to client-facing or strategic work, the stuff that actually grows the business.

We made one small change. Her assistant took over email triage and paperwork prep, and she committed to start each morning with a revenue-generating or relationship-building activity. Within a month she told us, "I feel like I got a day back every week."

That's the power of focusing your energy on the vital 20%. When you consistently prioritize high-value work and offload the rest, the business doesn't just run better, it grows faster and feels lighter.

6. Streamlining Your Marketing Strategy

One of the biggest marketing challenges I see in advisory practices is simple. Advisors spread themselves too thin. They try to show up everywhere - social media, webinars, email, events, podcasts - only to feel burned out and unsure whether any of it is working.

Doing fewer things better is always the key to predictable, sustainable marketing results. Identify what's working, and double down on it.

I think of an advisor we coached named Jason. He was posting daily on three social platforms, sending a weekly newsletter, hosting quarterly webinars, and feeling overwhelmed, and he hadn't gained a single new client in months.

We reviewed his marketing data and found something surprising. One topic, retirement income sequencing, accounted for almost all of his engagement, and nearly all his consulting calls came from a single webinar he did on that subject. Everything else was just noise.

Jason streamlined overnight. He focused his efforts on that core topic, recorded a refined version of the webinar, turned it into a short video series, and used snippets for social posts.

Within 60 days, he booked more qualified meetings than he had in the previous six months.

That's the power of the 80/20 rule in marketing.

Common Misconceptions about the Pareto Principle

- "It's always 80/20."

Not exactly. Sometimes it's 70/30 or 90/10. The pattern, not the ratio, is what matters. - "You ignore the bottom 80%."

Not true. You simply right-size your energy. - "Low-value clients don't matter."

Some may have untapped potential or strong referral influence. - "The 20% never changes."

It absolutely does. Re-evaluate regularly.

WHY THE PARETO PRINCIPLE RESONATES WITH FINANCIAL ADVISORS

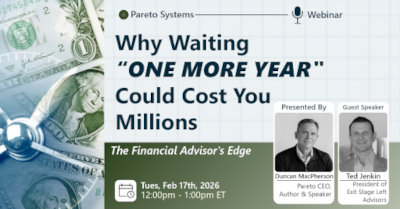

It's not an accident that Duncan MacPherson, CEO of Pareto Systems, chose to call the company what he did. Always fascinated by the underlying laws that affect business and individual interactions, he has spent over 20 years helping financial advisors implement process and focus their efforts on the 20 percent of their activities and clients that generate 80 percent of their business. Underlying forces like the Pareto Principle, the Law of Attraction, The Rule of Three and many more are not just aphorisms. They are the tools that elevate good to great.

The Pareto Principle highlights that reality and helps advisors lean into their strengths, focus on their best clients, and build practices that grow sustainably.

By Ryan Weeks

Media and Content at Pareto Systems