Thu

Thu

Duncan

Welcome to Pareto Central, the trusted source for thought leadership tailored for Financial Advisors. If you've arrived here through a trusted recommendation or discovered us in your own search, I'm glad you're here. Your interest in what we do means a lot.

At Pareto Systems, we're committed to sharing meaningful insights and processes that can enhance your practice and create positive change. Our resources-from books and podcasts to speaking engagements and webinars-are crafted to help you achieve your goals in a lasting, impactful way.

Explore, absorb, and engage with us as we continue this journey of growth. Welcome to the Pareto Systems community.

Top Financial Advisors

The Blue Square Method

It equips you with a proven philosophy and process for building the business you deserve, while tracking towards your "blue square," becoming the best version of yourself.

The Advisor Playbook

This proven financial advisor coaching process, developed by Duncan MacPherson and Chris Jeppesen, empowers you to grow your business with predictability and consistency.

The "Always On" Podcast

Grow Your Divorce Advisory Business

5 Strategic Steps From Niche to Notable

As a financial advisor who specializes in divorce, you've carved out a unique and valuable niche, often for deeply personal and empathetic reasons. Maybe you've seen a loved one struggle through a fi [...]

Testimonials and Online Reviews Marketing Strategy

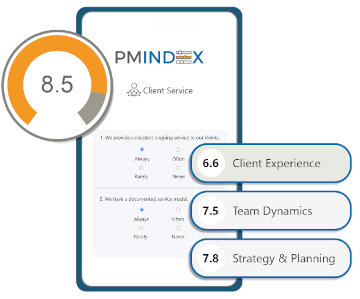

2025 Insights from the Practice Management Index

Master the Art of AI Prompting

Wealth Management Firm Valuation

Whether you're planning your succession, preparing to sell a portion of your book, or simply want to ensure your business is always sale-ready, this live Q&A is your opportunity to get direct, actionable insights from two of the industry's most respected voices.

Join Duncan MacPherson, author of The Blue Square Method, Ted Jenkin, and Scott DiGiammarino, a founding partners at JPTD Partners, as they answer your most pressing questions about building enterprise value, exploring partial exits, and navigating the complexities of succession planning.

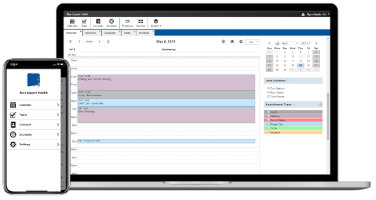

Pareto System's App

Relevant & Timely Videos

Relevant & Timely Videos Actionable Posts

Actionable Posts

In-depth Articles

In-depth Articles Pareto Academy (if subscribed)

Pareto Academy (if subscribed)

Duncan's YouTube Channel

Download our Guide to

Financial Advisor Coaching

The best of the best teams in history oftentimes, attribute their success to great coaching! This informative guide will help answer:

- What can a good financial advisor coach do for me?

- What questions should I ask when hiring a coach?

- What should I watch out for when hiring a coach?

- Is coaching worth the investment?

- And many more...