Latest Blog Article

Where the Pareto Principle Came From

(also known as the 80/20 rule)

I've understood the Pareto Principle for years, but what strikes me is how often it reveals itself in the day-to-day reality of the advisors we work with. No matter the practice size or business model, th [...]

Recent Blog Posts

Top 10 Podcasts for Financial Advisors

Ever feel like the financial industry is shifting faster than you can keep up? You're not alone. Between market fluctuations, new regulations, the AI craze and keeping your clients happy, it's easy [...]

Guide to Financial Advisor Coaching

How to Explore Coaching Benefits & CostsAre you spinning your wheels trying to grow your business? Do you have growth, but want more time to spend with fam [...]

Master the Art of AI Prompting

A Framework for Financial Advisors. AI can be a game-changer for financial professionals if you know how to use it effectively. An overlook [...]

The Ultimate Financial Advisor Tech Stack

Learn what technology advisors are using in 2025We find that the average financial advisor spends a staggering 41% of their week buried in administrative tasks. But interestingly enough, w [...]

Grow Your Divorce Advisory Business

5 Strategic Steps From Niche to NotableAs a financial advisor who specializes in divorce, you've carved out a unique and valuable niche, often for deeply personal and empathetic reasons. M [...]

Testimonials and Online Reviews Marketing Strategy

Waiting to Embrace Online Reviews. That's the Real Risk. In a profession built on trust, few things are more powerful than the words of a satisfied client.Until recently, fina [...]

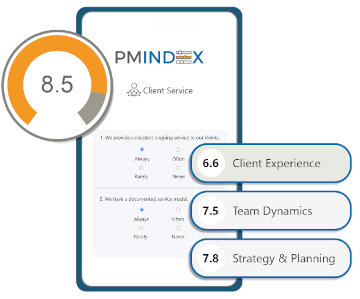

2025 Insights from the Practice Management Index

In this year's 2025 Practice Management Trends Report, our goal is to uncover the drivers of success by analyzing the activities and strategies that financial advisors focused on throughout 2024. W [...]

Wealth Management Firm Valuation

What Is Your Business Really Worth? "Every business is built to be sold" isn't just a saying. It's valuable advice for all business owners, including financial adviso [...]

2025 Annual Report on Transitions

Financial Advisor Activity Data and Deals in 2024 Download now: [...]

Top AI Tools for Financial Advisors

What Problems Does AI Solve? Ultimately, it comes down to improving productivity and efficiency, and helping you save time and money. AI can enable every member of your team to create [...]

Transitioning to a new firm?

START THE NEXT CHAPTER WITH THE RIGHT FIRM Transitioning with the Financial Advisor Flight Plan: [...]

Top Books for Financial Advisors

Do you ever feel like there just aren't enough hours in the day to devour all the incredible business books out there? You (like me and many out there) constantly seek out ways to improve your craf [...]

Secret of Financial Advisor Marketing

Client retention is the strategyIs your business growing as fast as you'd like? Or is Client churn taking a toll on your practice? These are a major challenge [...]

Building Your Brand

Financial Advisor Branding: The Key to Long-Term ROI Advisors frequently ask me which marketing strategies are best for client acquisition. And while there is a place [...]

The Subtle Power of Branding

Branding: Beyond Aesthetics Does your value stand out to clients? How does your brand make someone feel initially, and then over time? You probably know the names Mar [...]

Differentiating Begins with a Personal Branding Strategy

Financial Advisor Branding: How to Stand Out From the CrowdBranding is different from marketing in that it more quickly impacts how a prospective client perceives you at t [...]

What is Branding?

Understanding Financial Advisor Branding: It's More Than Just MarketingSimply put, it's someone's interpretation for value being offered that aligns with a want or need th [...]

Putting Success in Succession

Are you looking toward succession in your practice? Are you dependent on a protg or partner to make all the gears mesh? Who's deciding where the ship is heading? Most importantly, will it work, bot [...]

Prepare for the Sale of Your Practice

As a financial advisor, preparing for the sale of your practice is a meticulous process that demands consideration of many factors. Whether you're planning for retirement [...]

10 Questions for your Client Advisor Council

Advisors have seen that Client Advisor Councils (CAC) can be extremely beneficial to the growth of their practice and for refinements to their process that they continue to make over time. As an ex [...]

The Power of Client Advisory Councils

I've often emphasized the transformative impact of Client Advisory Councils. These councils are not just strategic tools, but platforms for profound engagement. They bring advisors and clients toge [...]

5 Steps to Generating Consistent Referrals

Developing an effective On-Boarding ProcessMy favorite topics for these articles stem from conversations I have with our coaching staff at Pareto Systems who share success s [...]

Bringing Success to Your Succession

In our on-going consulting work, we find more and more financial advisors want to position themselves to successfully: Buy a practiceSell a practiceBring on a pro [...]

ChatGPT: Revolutionizing Client Communication for Financial Advisors

In the ever-changing field of consulting and financial advice, staying ahead of the curve is a necessity; but it's also a duty we owe to our clients. As the head of Pareto Systems, I've witnessed v [...]

Stewardship and the Anatomy of a Referral

On a macro level, you have to get clear on the mechanics and motivations that lead to consistent referrals. Start by asking yourself two questions:Why don't they?Why should the [...]

2024 Financial Industry Trends Report

Gain Insights from the 2024 Financial Industry Practice Management Trends ReportWhen we launched the Practice Management Index in 2022, we had no idea how quickly this tool would be adopte [...]

The Law of Diminishing Intent

Take a moment to think back to the last time you stumbled upon a fabulous idea. Maybe this new concept was about your financial practice or maybe it had more of a domestic spin to it. Regardless of [...]

Are You Franchise-Ready?

What would happen if you took a month off starting tomorrow? Would your business spiral into chaos or would it run like a Swiss watch? What would happen if one of your key team mem [...]